It's time for a review of what's working at what's not over the last year.

As you may have noticed, it has not been a great year for most basket rotation strategies I follow.

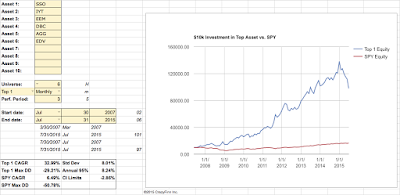

The exception being "Simple Pair Switching", which between Aug 01, 2014 and Aug 01, 2015 returned a nice +18.69%, with no losing periods. Holding the US stock market (SPY) also returned a nice +9.64% for the same period. Buying the dips is also still working.

What worries me about the following rotation strategies is the depth and length of the drawdowns and volatility compared to the S&P500 index. Looking at the long-term equity curve from a technical analysis perspective also doesn't appear pretty. With the exception of the "Modified Dual Momentum" strategy, it seems like the upward trends of the equity-curves have been violated with a "lower low".

For the monthly rotation strategies I follow, I've presented graphs/stats for a 1 year return, as well as graphs/stats in the larger context, going back before the 2008 financial crisis (except for the "Modified Dual Momentum", for which some of the ETF's didn't exist before 2008). All charts except the "Modified Dual Momentum" strategy are presented courtesy of my "Universal Rotation Strategy Backtesting Tool". Modified Dual Momentum is courtesy of Portfolio Visualizer, though instead of assigning 20% to the 63-day volatility (semi-variance), which was not included as an option, I used 2-month return.

Simple GMR

CAGR: -14.59%

Max DD: -21.13%

Global Market Rotation

CAGR: -14.01%

Max DD: -20.18%

Global Transportation with Commodities

CAGR: -14.31%

Max DD: -29.21%

Modified Dual Momentum

CAGR: 2.97%

Max DD: -11.28%

Do you have an explanation for that? Is it the switching on the last or first day of the month? Should one switch mid month?

ReplyDeleteThat is a very good question; I think one explanation is that most asset classes have been performing pretty abysmally recently and in most other markets outside the the US stock markets volatility has has substantially increased. Probably because of the increased volatility, we've had a number of whipsaws, which the systems mistook for strength, whereas the strength ended up being very short-lived. Mid-month switching may have helped for this particular time period, however I feel that even if it did, it would be more likely to be curve-fitting rather than improving the system. I'd be happy to hear any other thoughts! -QH

Delete