Well that didn't last long...

As of December 4, 2015, the "Simple Pair Switching" strategy has given a signal to switch allocations from stocks back to bonds. The return for SPY (SPDR S&P 500 ETF) for the previous period is +0.4%, based on the adjusted close prices of November 30, 2015 and December 4, 2015. TLT (iShares 20+ Year Treasury Bond ETF) would've returned -0.5% for the same period.

QuantHead

Ideas for Quantitative & System Based Investing

Welcome to QuantHead!

Welcome to QuantHead! I hope you find some interesting ideas here that I've encountered on my journey of learning and share your wisdom with me. Enjoy!

Thursday, December 10, 2015

Tuesday, December 1, 2015

December 2015 Allocations

I've decided to stop tracking the GMR, Simple GMR and GTCR strategies, since in my books, they've failed in their promise. I'm keeping Dual Momentum around for now, with the addition of the two new strategies I recently presented: Vanguard High Growth and Low Volatility Bond strategies.

Monday, November 30, 2015

Simple Pair Switching Update

As of November 30, 2015, the "Simple Pair Switching" strategy has given a signal to switch allocations from bonds to stocks. The return for TLT (iShares 20+ Year Treasury Bond ETF) for the previous period is -1.2%, based on the adjusted close prices of August 13, 2015 and November 30, 2015.

SPY (SPDR S&P 500 ETF) would've returned +0.5% for the same period.

Friday, November 13, 2015

Cliff Smith's Low Volatility Bond Strategy

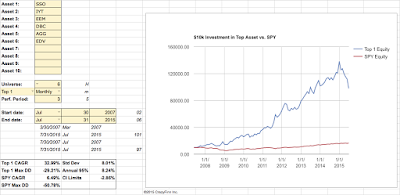

Cliff is at it again! He recently presented another interesting strategy utilizing municipal bonds, high yield bonds, mortgage securities and intermediate term U.S. treasuries. The strategy ranks the assets by their 10-day return (which is a lot shorter of a timespan than the often used period of several months). At the beginning of every month, as long as an asset is equal to or above its 10-SMA, the strategy invests in the top1 ranked asset. If no assets are equal to or above their 10-SMA, the strategy goes to / stays in cash (or very short term U.S. treasuries).

One can easily replicate Cliff's backtest on Portfolio Visualizer with the basket of OPTAX, FHYTX, FMSFX, DRGIX and CASHX, resulting in a CAGR of +11.62% and Max DD of -6.64% (1988-2015) or +11.34% / -5.60% (2000-2015).

One can find similar no load, no transaction fee funds at Fidelity and Schwab, yielding a similar (or actually better) performance with the basket of NHMAX, CPHYX, PTMDX, NEFLX and CASHX, resulting in a CAGR: +12.18% and Max DD of -2.92% (2000-2015). Instead of CASHX, one can use proxies SHY or SCHO. It is to be noted that the mutual funds have a 30-day minimum holding period.

The upside of this strategy is that it provides an amazing risk-to-reward ratio with a smooth equity curve and a very low maximum drawdown, assuming that it will continue to perform as it has for the last few decades.

The downside of this strategy is that for both Schwab and Fidelity, though there are no-load and no transaction fees on these funds, a redemption fee of $49.95 (when a fund is sold before 90 days) applies, so the strategy averaging about 7 trades a year, translates to it costing about $350 / year to run. On a $10,000 portfolio this translates to an annual cost of 3.5% and on a $100,000 portfolio 0.35%, so it's definitely not cheap on smaller accounts.

As usual, I've created a dynamic spreadsheet to follow this strategy, or one can use Portfolio Visualizer as well.

QH Low Volatility Bond

One can easily replicate Cliff's backtest on Portfolio Visualizer with the basket of OPTAX, FHYTX, FMSFX, DRGIX and CASHX, resulting in a CAGR of +11.62% and Max DD of -6.64% (1988-2015) or +11.34% / -5.60% (2000-2015).

One can find similar no load, no transaction fee funds at Fidelity and Schwab, yielding a similar (or actually better) performance with the basket of NHMAX, CPHYX, PTMDX, NEFLX and CASHX, resulting in a CAGR: +12.18% and Max DD of -2.92% (2000-2015). Instead of CASHX, one can use proxies SHY or SCHO. It is to be noted that the mutual funds have a 30-day minimum holding period.

The downside of this strategy is that for both Schwab and Fidelity, though there are no-load and no transaction fees on these funds, a redemption fee of $49.95 (when a fund is sold before 90 days) applies, so the strategy averaging about 7 trades a year, translates to it costing about $350 / year to run. On a $10,000 portfolio this translates to an annual cost of 3.5% and on a $100,000 portfolio 0.35%, so it's definitely not cheap on smaller accounts.

As usual, I've created a dynamic spreadsheet to follow this strategy, or one can use Portfolio Visualizer as well.

QH Low Volatility Bond

Monday, November 9, 2015

Cliff Smith's Vanguard High Growth Strategy

It's been a while since I've presented any new strategies, since it's been tough to find rotation strategies that have previously worked well, and are still exhibiting good returns in 2015.

Cliff Smith recently presented a strategy on Seeking Alpha that he calls "Vanguard High Growth Strategy", which can be easily backtested on Portfolio Visualizer from 1988-2015 (1987-2015 without the comparison to the S&P 500), yielding a +15.10% CAGR and -9.09% Max Drawdown with a very smooth and stable equity curve. There are no losing years, the worst return was +2.66% in 2001. The strategy is based on 4 Vanguard mutual funds, which basically means that for the strategy to work efficiently and to avoid commissions, one should have an account with Vanguard.

The selected funds are Vanguard Convertible Securities Fund Investor Shares (VCVSX), Vanguard High-Yield Corporate Fund Investor Shares (VWEHX) and Vanguard Health Care Fund Investor Shares (VGHCX). The strategy stays invested in the selected assets (equal weight) when the monthly adjusted close price of an asset is greater or equal to its 2-month EMA. If not, the specific portfolio slice is invested in Long-term U.S. Treasuries (VUSTX).

One should note that the Vanguard mutual funds have a 30-day minimum holding period. One can use Portfolio Visualizer to track the portfolio investments at the end of each month, and I've also created a dynamic Google spreadsheet for this strategy. It'll be interesting to see if this strategy can maintain as smooth an equity curve as it has over the last almost 3 decades.

QH Vanguard High Growth Spreadsheet

Cliff Smith recently presented a strategy on Seeking Alpha that he calls "Vanguard High Growth Strategy", which can be easily backtested on Portfolio Visualizer from 1988-2015 (1987-2015 without the comparison to the S&P 500), yielding a +15.10% CAGR and -9.09% Max Drawdown with a very smooth and stable equity curve. There are no losing years, the worst return was +2.66% in 2001. The strategy is based on 4 Vanguard mutual funds, which basically means that for the strategy to work efficiently and to avoid commissions, one should have an account with Vanguard.

The selected funds are Vanguard Convertible Securities Fund Investor Shares (VCVSX), Vanguard High-Yield Corporate Fund Investor Shares (VWEHX) and Vanguard Health Care Fund Investor Shares (VGHCX). The strategy stays invested in the selected assets (equal weight) when the monthly adjusted close price of an asset is greater or equal to its 2-month EMA. If not, the specific portfolio slice is invested in Long-term U.S. Treasuries (VUSTX).

One should note that the Vanguard mutual funds have a 30-day minimum holding period. One can use Portfolio Visualizer to track the portfolio investments at the end of each month, and I've also created a dynamic Google spreadsheet for this strategy. It'll be interesting to see if this strategy can maintain as smooth an equity curve as it has over the last almost 3 decades.

QH Vanguard High Growth Spreadsheet

Saturday, October 31, 2015

Thursday, October 1, 2015

Friday, September 11, 2015

Market Snapshot

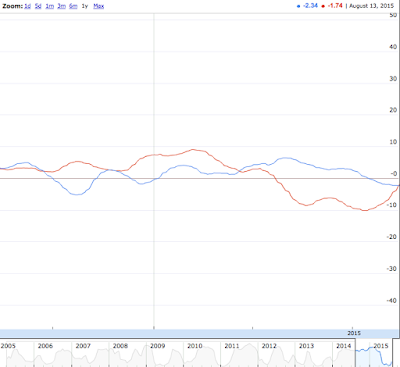

The following chart is my window into the market, a snapshot that I glance at every day. It provides me a wealth of information of the overall U.S. stock market, all in one glance.

The topmost section charts the price action of the U.S. stock market (S&P 500). The second section charts the NYSE advance/decline cumulative average, along with its 200-day moving average. The third section charts the treasury yield curve (10-year minus 3-month yield). The bottom section charts the S&P 500 volatility index (VIX).

The current takeaway is that we're experiencing a correction, the total depth of it being -12.4% (so far). The NYSE advance/decline cumulative average has crossed below its 200-day moving average, which is a warning sign. However, if history is to repeat itself (which of course isn't a given), for there to be a major bear market looming (save a black swan event, such as the Black Monday crash of 1987), the treasury yield curve should've dipped below 0, which as we can see is not even close to it.

I like to look at the VIX to seek out potential crowd fear moments. For me, if the VIX spikes above 40, it's often a great way to take advantage of a pullback, as long as the upward trend resumes and we don't enter a bear market. The VIX spiked over 40 on August 24, 2015, and ever since the $SPX has recovered +4.8%. Whether the upward trend resumes shall remain to be seen.

Feel free to modify the chart to your liking, using the link to it below.

QH Market Snapshot

Monday, August 31, 2015

September 2015 Allocations

The Simple GMR drawdown is now at a historic -22%, MC GMR -29% and GTCR -37%! This really highlights the importance of a forward-walk/paper-trading to ensure the strategies work in real life and not only when backtested. On a more positive note, Simple Pair Switching switched the allocation to bonds 4 days before the crazy action in the S&P 500 started. TLT is currently down -1.8% from the August 13 switch date, and SPY -5.3%. And as the Modified Dual Momentum strategy indicates, it is currently very hard to find any asset classes that are generating better returns than cash/short term bonds (SHY).

Thursday, August 13, 2015

Simple Pair Switching Update

As of August 13, 2015, the "Simple Pair Switching" strategy has given a signal to switch allocations from stocks to bonds. The return for SPY (SPDR S&P 500 ETF) for the previous period is -0.1%, based on the adjusted close prices of March 23, 2015 and August 13, 2015.

Though not a return to write home about, it's worth noting that TLT (iShares 20+ Year Treasury Bond ETF) would've returned -4.8% for the same period, so the strategy definitely picked the lesser of two evils.

Monday, August 3, 2015

What Works and What Doesn't

It's time for a review of what's working at what's not over the last year.

As you may have noticed, it has not been a great year for most basket rotation strategies I follow.

The exception being "Simple Pair Switching", which between Aug 01, 2014 and Aug 01, 2015 returned a nice +18.69%, with no losing periods. Holding the US stock market (SPY) also returned a nice +9.64% for the same period. Buying the dips is also still working.

What worries me about the following rotation strategies is the depth and length of the drawdowns and volatility compared to the S&P500 index. Looking at the long-term equity curve from a technical analysis perspective also doesn't appear pretty. With the exception of the "Modified Dual Momentum" strategy, it seems like the upward trends of the equity-curves have been violated with a "lower low".

For the monthly rotation strategies I follow, I've presented graphs/stats for a 1 year return, as well as graphs/stats in the larger context, going back before the 2008 financial crisis (except for the "Modified Dual Momentum", for which some of the ETF's didn't exist before 2008). All charts except the "Modified Dual Momentum" strategy are presented courtesy of my "Universal Rotation Strategy Backtesting Tool". Modified Dual Momentum is courtesy of Portfolio Visualizer, though instead of assigning 20% to the 63-day volatility (semi-variance), which was not included as an option, I used 2-month return.

Simple GMR

CAGR: -14.59%

Max DD: -21.13%

Global Market Rotation

CAGR: -14.01%

Max DD: -20.18%

Global Transportation with Commodities

CAGR: -14.31%

Max DD: -29.21%

Modified Dual Momentum

CAGR: 2.97%

Max DD: -11.28%

Tuesday, June 30, 2015

Friday, May 29, 2015

Friday, May 22, 2015

10,000 Page Views!

The U.S. clearly shows the most interest, and I'm happy to see readers from around the world.

Of the strategies presented, the Global Market Rotation model takes the all-time lead, though in the recent months the Modified Dual Momentum model has presented, well - the most momentum!

Monday, May 18, 2015

Treasury Yield Curve

Low interest rates pose a major concern for the current market environment, especially as far as rotation strategies are involved. As witnessed by the chart of the 10-year U.S. Treasury Note (^TNX), we've been in a general environment of declining interest rates since the early 1980's, which also has been fueled by the dovish monetary policy of the Federal Reserve over recent years.

The reason this poses a concern is that once the Federal Reserve determines that it will no longer continue its quantitative easing policy, interest rates should start to rise. Especially the bond market will likely be adversely affected by this. Many of the rotation strategies don't have a cash-stop, but rather use (long-term) U.S. Treasuries as a safe-haven when stocks start to underperform. However, in a rising rate environment, especially long-term bonds may no longer act as a safe-haven in case of a pullback, correction or a prolonged bear-market. Therefore it becomes crucial to know when rotation strategies may no longer perform as expected (i.e. when to get out). Even with a buy-and-hold strategy, a typical 60/40 or 70/30 stocks to bonds allocation may no longer work to minimize portfolio drawdowns in a rising rate environment.

I recently came across this chart, provided by LPL Financial Research. It shows how, since 1967, treasury yield curve inversions have marked stock market peaks before a downturn and recession.

Though surprisingly accurate, the yield curve sometimes gives a signal way before the correction, e.g. August 2006 signaled a downturn, which didn't actually start until October 2007.

This made me wonder that maybe if I combined the indicator with the "AdvDecnCumAvg" indicator that I provided a few posts ago, I'd get a more robust signal system.

I analyzed all U.S. bear markets since 1966, listed at Gold-Eagle. Though not an official bear market (> -20%), I also included the correction of July 1990 - October 1990 (~ -15%), which was predicted. Both indicators gave a false positive in December 1978 and the Black Monday crash of 1987 was not predicted. There was no AdvDecn data available for the first bear market of 1966, but the yield curve signaled the downturn very accurately.

Occasionally the yield curve would provide the first signal (yellow), and at other times AdvDecn would provide the first signal. The second (green) signal acts as the final trigger signal.

Though admittedly not that many data points, existing data would suggest that when using these two indicators in conjunction with each other, assuming historical data applies in the future, we can somewhat accurately predict a future major downturn in the stock market without leaving too much on the table by running to the fences prematurely.

A glance at the treasury yield curve today, on May 18, 2015, along with the AdvDecnCumAvg, would suggest that a major market correction isn't looming behind the corner, yet. Please find the link to the automatically updating Google Sheet below.

QH U.S. Treasury Yield Curve

Saturday, May 9, 2015

S&P 500 Smart Money Screener

To continue on our journey of screening for market anomalies, I've created a "smart money" screener for the S&P500. Quantified Alpha recently published an article that identifies market anomalies that have been academically proven to provide alpha (i.e. risk-adjusted outperformance over the overall market), or in English; proven "to work", when systematically exploited.

The first of the identified anomalies is the value anomaly, stating that over the long run, the returns of cheap stocks outperform expensive stocks. My previous post with the value screener may be helpful to identify stocks or sectors that currently identify themselves as good value.

The second anomaly is the momentum anomaly, stating that on average, past winners continue to outperform and past losers will continue to underperform. Most of the QuantHead blog concentrates on the momentum anomaly with providing relative strength (/ absolute strength) rotation models.

The third anomaly is the "smart money" anomaly, which states that when company insiders, financial institutions and short sellers are bullish on a stock, it tends to outperform and vice versa. The article suggests three metrics to focus on: 1) short interest as % of total float, 2) net change in company insider ownership over the last 6 months and 3) net change in institutional ownership over the last 3 months.

By using a similar approach for my smart money screener as the value screener of the previous post, these three metrics are each ranked from 0-100%, summed up and ranked again from 0-100%, providing a "Smart Money Rank". I also provide a "Trending Smart Money Rank", which ranks the top decile (50 stocks) by their 6-month performance. And once again I provide a chart, which I call "Smart Money Sectors". It would seem that as of May 9, Financials and Consumer Goods are in the lead. Please find the link to the spreadsheet below.

The fourth anomaly according to Quantified Alpha is the business quality anomaly, which states that companies that manipulate their earnings in the short-term will vastly underperform in the long-run. I don't have access or haven't been able to find any of the data that they suggest as metrics to focus on: 1) R/D expenses as percentage of assets, 2) earnings accruals as percentage of assets, 3) external financing to assets, 4) depreciation to capital expense ratio. Therefore, I'm not able to build a screener for the fourth anomaly.

The fifth anomaly is the earnings momentum anomaly, which states that companies that have beaten analyst estimates in the past, are likely to keep beating them in the future. The suggested metrics are 1) streak of EPS/revenue beats in a row, 2) last quarter EPS/revenue surprise % and 3) number of estimate beats in the last 3 years. Similar as to the fourth anomaly, I don't currently have access to these metrics, so I won't be able to build a screener for the fifth anomaly.

For anyone interested, it might be possible to build screeners for the fourth and fifth anomalies with Quantshare, Amibroker or Equities Lab, though like Quantified Alpha, these services require a subscription or an upfront fee.

QH S&P 500 Smart Money Screener

The first of the identified anomalies is the value anomaly, stating that over the long run, the returns of cheap stocks outperform expensive stocks. My previous post with the value screener may be helpful to identify stocks or sectors that currently identify themselves as good value.

The second anomaly is the momentum anomaly, stating that on average, past winners continue to outperform and past losers will continue to underperform. Most of the QuantHead blog concentrates on the momentum anomaly with providing relative strength (/ absolute strength) rotation models.

The third anomaly is the "smart money" anomaly, which states that when company insiders, financial institutions and short sellers are bullish on a stock, it tends to outperform and vice versa. The article suggests three metrics to focus on: 1) short interest as % of total float, 2) net change in company insider ownership over the last 6 months and 3) net change in institutional ownership over the last 3 months.

By using a similar approach for my smart money screener as the value screener of the previous post, these three metrics are each ranked from 0-100%, summed up and ranked again from 0-100%, providing a "Smart Money Rank". I also provide a "Trending Smart Money Rank", which ranks the top decile (50 stocks) by their 6-month performance. And once again I provide a chart, which I call "Smart Money Sectors". It would seem that as of May 9, Financials and Consumer Goods are in the lead. Please find the link to the spreadsheet below.

The fourth anomaly according to Quantified Alpha is the business quality anomaly, which states that companies that manipulate their earnings in the short-term will vastly underperform in the long-run. I don't have access or haven't been able to find any of the data that they suggest as metrics to focus on: 1) R/D expenses as percentage of assets, 2) earnings accruals as percentage of assets, 3) external financing to assets, 4) depreciation to capital expense ratio. Therefore, I'm not able to build a screener for the fourth anomaly.

The fifth anomaly is the earnings momentum anomaly, which states that companies that have beaten analyst estimates in the past, are likely to keep beating them in the future. The suggested metrics are 1) streak of EPS/revenue beats in a row, 2) last quarter EPS/revenue surprise % and 3) number of estimate beats in the last 3 years. Similar as to the fourth anomaly, I don't currently have access to these metrics, so I won't be able to build a screener for the fifth anomaly.

For anyone interested, it might be possible to build screeners for the fourth and fifth anomalies with Quantshare, Amibroker or Equities Lab, though like Quantified Alpha, these services require a subscription or an upfront fee.

QH S&P 500 Smart Money Screener

Saturday, May 2, 2015

S&P 500 Value Screener

May 4, 2015 Update: The sectors are now inversely weighted according to each sector's weight in the S&P 500, for a better representation of undervalued sectors.

Paul bases his composite value score on the insights of several quant researchers (including the book "What Works on Wall Street") that choosing stocks based on a composite of value metrics over time outperforms portfolios based on solely one metric.

Determining a valuation of a company is often difficult, especially when trying to compare valuations across sectors and industry groups. Some like to look at the price-to-earnings ratio (P/E), but a lot of tech stocks often trade at seemingly premium value. Some like price-to-book (P/B), but REITs often trade below their book values. There seems to be trade-off's with each valuation metric.

I've attempted to create a valuation score similar to Paul's composite value metrics, which takes into account price-to-earnings (P/E), price-to-book (P/B), price-to-sales (P/S), price-to-free cash flow (P/FCF), enterprise value-per-earnings before interest, taxes, depreciation and amortization (EV/EBITDA) and dividend yield.

Each metric is ranked by percentage, 100% is granted to the best ranking stock. If data (dynamically pulled from FinViz and Yahoo Finance) for a metric is missing, a value of 50% is assigned for that metric, to reduce an unfair bias against the stock.

All the metrics are then summed up and once again ranked from 0-100% to provide a "Valuation and Yield Rank". The last column: "Trending Value Rank", similar to Paul's "Trending Value System", takes the top decile (50 stocks) of the "Valuation & Yield Rank", and ranks them by their 6-month performance.

I've also added a second sheet, "Undervalued Sectors", which shows the sectors of the 50 currently highest ranked stocks. Whether you decide to sort the stocks (from Z-A) by valuation and yield alone, or also taking into account recent price performance, it would seem that as of May 2, 2015, "Financials" and "Basic Materials" boast some of the best valued stocks of the S&P 500.

Thursday, April 30, 2015

May 2015 Allocations

Here's a review of 2015 so far; two of the monthly rotation strategies are currently outperforming the U.S. stock market, and two are lagging.

January-April 2015 cumulative returns

1. MC GMR: +7.5%

2. Simple GMR: +2.7%

3. Buy and hold S&P 500: +1.9%

4. GTCR: -0.6%

5. Modified Dual Momentum: -1.62%

Happy May Day!

Tuesday, April 28, 2015

Advance/Decline Cumulative Average

I've created a new dynamic, automatically updating spreadsheet for following the NYSE Advance Decline Cumulative Average. It's essentially the same as the TOS study I shared in my very first post, but the data now extends all the way into the 1960's. A word of warning; because of the massive data-pull (daily data for approx. 50 years), the spreadsheet easily takes a couple of minutes to load, even with a fast internet connection.

The study draws a line that is the running sum of the daily percent change of the advancing issues compared to declining issues, and another line that is a 252 day moving average (the typical number of trading days over one calendar year).

The study isn't a holy grail by any means, but can give early warning signs as well as early recovery signs, either by the signal line crossing over the moving average (which worked well signaling the beginning and end of the 2008 bear market) or by negative and positive divergences (e.g. during the period of 1998-2003).

In addition to the chart with the AD lines, I've included a chart with the S&P 500 index for comparison purposes.

QH AdvDecCumAvg Spreadsheet

The study draws a line that is the running sum of the daily percent change of the advancing issues compared to declining issues, and another line that is a 252 day moving average (the typical number of trading days over one calendar year).

The study isn't a holy grail by any means, but can give early warning signs as well as early recovery signs, either by the signal line crossing over the moving average (which worked well signaling the beginning and end of the 2008 bear market) or by negative and positive divergences (e.g. during the period of 1998-2003).

In addition to the chart with the AD lines, I've included a chart with the S&P 500 index for comparison purposes.

QH AdvDecCumAvg Spreadsheet

Subscribe to:

Comments (Atom)